More than 70% of some of the world’s biggest emitters have ‘glaring absence of climate risks in financial reporting’

Report finds Wendy's, Loblaw and Beyond Meat don't disclose all emissions

It’s time for companies and securities regulators to make sure the whole truth of Indigenous rights claims are brought to light through

How can we sift through greenwashing to spot genuine climate action?

We look under the hood of BlackRock's new Carbon Transition ETF to see if it delivers on its low-carbon promise

Despite signs of progress, Canada’s pension funds continue to pursue investing strategies that keep us on the pathway to catastrophic climate change

Nasdaq pushes for diverse boards while two asset managers continue to vote down most climate-related shareholder resolutions

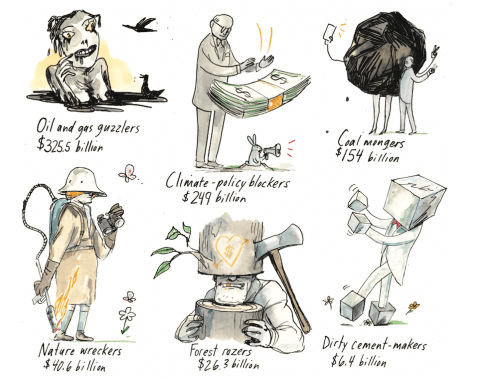

The world’s three biggest asset managers together hold US$774 billion in equity in the worst climate offenders

From the Quakers outlawing the buying and selling of humans to the U.K. government buying green bonds, we chronicle 260 years

Regulating the “greenwash” out of sustainable investing is critical to curbing growing climate crisis, insiders say