Li-Cycle once seemed like a leader among the start-ups trying to recycle electric vehicle batteries in the United States. Now it’s mired in bankruptcy proceedings.

The company’s board replaced the CEO and CFO in a decision announced May 1, when Li-Cycle publicized that it was looking for buyers. A potential deal with mining giant and lead creditor Glencore evidently had not come to fruition: Two weeks later, a Canadian bankruptcy court appointed Alvarez & Marsal Canada Securities to oversee a sale of Li-Cycle’s assets. A Li-Cycle spokesperson referred Canary Media to the company’s public bankruptcy announcements.

Prospective buyers for the partially completed recycling empire can state their intent by early June. In the meantime, Glencore has loaned $10.5 million to keep things going during the proceedings. Glencore also entered a “stalking horse” offer of $40 million for most of Li-Cycle’s holdings, setting a floor for bidding (if any other investors want a piece of the action). Glencore could emerge with a real deal on its hands, but it won’t be recouping the $275 million it previously invested in Li-Cycle.

“The Company represents a compelling investment opportunity, uniquely positioned to benefit from rapid growth in the battery materials and [lithium-ion battery] recycling market, amid increasing global focus on sustainability and critical raw material supply chain resilience,” Alvarez & Marsal pitch in a flyer for the sale.

That “compelling” opportunity amounts to five battery shredding plants, a massive unfinished recycling centre in western New York, and a business predicated on the growth of a nascent North American EV supply chain that currently faces far-reaching disruption from the Trump administration. A buyer would not be able to fully recycle any batteries without spending a few hundred million dollars more, and even then, it’s not clear they would make any money doing so.

The start-up’s collapse underscores the struggles of the fledgling battery-recycling industry in general. A few years ago, the sector was flush with venture capital and charting out rapid timelines for commercializing breakthrough technologies that would enable the transition to EVs while minimizing mining. The sector was also seen as a way to achieve the bipartisan goal of reducing dependence on China, which dominates the global battery supply chain.

Li-Cycle was founded in Canada in 2016 and went public in 2021 through a special-purpose acquisition company, or SPAC (generally a red flag for early-stage cleantech companies). Its engineers developed a technique for shredding whole lithium-ion battery packs while they’re submerged in liquid; this prevented fires and saved considerable effort compared with painstakingly discharging and dismantling the packs for processing.

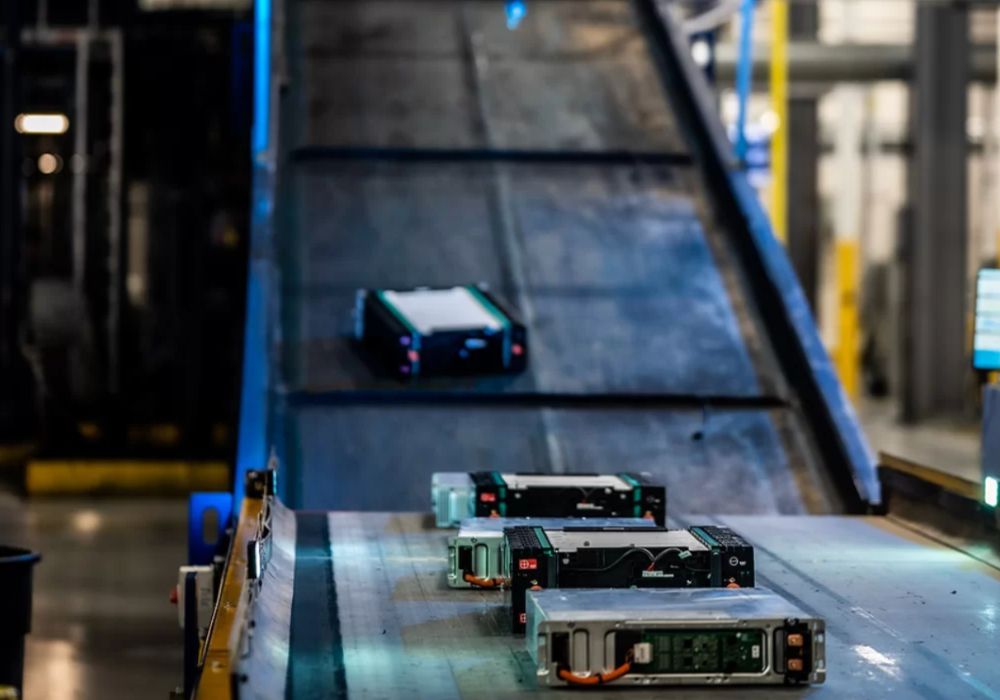

Li-Cycle successfully built five “spoke” facilities to collect and shred whole EV battery packs, turning them into the powdery mixture known as black mass. The spoke operations have paused in Arizona, Alabama, New York and Ontario, while a German outpost continues to function during bankruptcy proceedings. Collectively, these facilities can break down up to 40 kilotons of batteries a year.

The spokes were supposed to feed their black mass to Li-Cycle’s hub in Rochester, New York, which would refine it and isolate useful battery materials to reintroduce into the supply chain. This never came to pass because Li-Cycle halted construction in fall 2023, citing runaway costs. It became clear that Li-Cycle needed to find a lot more cash to complete the nearly two-million-square-foot site.

Prospective buyers for the partially completed recycling empire can state their intent by early June.

The company hoped for a lifeline from the Biden-era Department of Energy: in November, its Loan Programs Office finalized a $475-million loan for Li-Cycle to complete the recycling hub. But Li-Cycle never drew on that federal money because it couldn’t secure additional private funding to hold in reserve, as stipulated in the loan terms.

Li-Cycle is not the only battery recycling firm in a tough spot. Since last year, a number of challenges have beset the industry.

The adjacent U.S. EV sector has seen slower growth than expected, which has in turn reduced the urgency of building out a North American battery supply chain. Core battery materials like lithium, nickel and cobalt have plummeted in price, lessening the value of whatever recyclers might glean. And battery makers have increasingly turned to lithium iron phosphate, a cheaper alternative to nickel- and cobalt-based chemistries, further reducing the value of recycling these batteries.

RELATED:

Canada‘s largest battery storage farm just opened – and it’s Indigenous-led

New supply-chain ‘passports’ pave the way for more recycling of EV batteries

In the past year, a fire destroyed the largest battery-shredding plant in the United States, Interco’s Critical Mineral Recovery site in Missouri. Reno, Nevada–based Aqua Metals ran low on funds and laid off staff while it searched for financing to build a commercial-scale recycling line. Ascend Elements delayed construction of its flagship recycling plant in Kentucky, citing a customer’s decision to postpone buying the recycled materials. In March, Ascend cancelled plans to make cathode active materials in Kentucky to focus on precursor materials and lithium carbonate.

Redwood Materials is the rare bright spot. The venture by former Tesla CTO JB Straubel raised a couple billion dollars and has been building out a major compound in the desert outside Reno, not far from Tesla’s factory there. In 2024, Redwood Materials broke down 20 gigawatt-hours of batteries and earned $200 million in revenue from recycled materials.

The industry’s challenges come as the Trump administration says it aims to expand U.S. mineral supplies. Paradoxically, the administration has taken steps to undermine the fledgling U.S. EV and battery industries, which are the big drivers of demand growth for rare earth metals. The budget bill passed by the House last week would strip tax incentives for EV purchases and battery installations, weakening demand for the domestic supply chain that recyclers like Li-Cycle hoped to serve – and making the tough road for recycling firms even tougher.

This article was first published by Canary Media. It has been edited to conform with Corporate Knights style. Read the original article here.

The Weekly Roundup

Get all our stories in one place, every Wednesday at noon EST.