Find out which G20 countries and sectors are on pace to meet 2030 emissions reductions targets, and where help is needed.

READ EARTH INDEX REPORT | READ EARTH INDEX STORIES | READ DECARBONIZATION CASE STUDIES

WHAT IS EARTH INDEX?

EARTH INDEX is the fundamental metric that measures the speed at which countries (by sector) are reducing greenhouse gas (GHG) emissions relative to the speed required to deliver on their commitments.

Its objective is to create real-time global awareness of whether annual GHG emissions are being reduced fast enough to follow through on the long-term targets countries have set. We begin by focusing on G20 countries, which account for about 80% of global GHG emissions.

EARTH INDEX has been developed and refined with the input of many collaborators and stakeholders, including Corporate Knights’ research division, an advisory network of eminent experts in related fields, and ongoing contributions from CEOs of the Global 100 Most Sustainable Corporations in the World.

WHY DO WE NEED IT?

With the Glasgow Climate Pact, governments came forward for the first time with sufficiently ambitious targets to hold global warming to below 2°C. But when countries state long-term targets without short-term accountability, trust erodes, which undermines the public consensus required to achieve targets. Increased transparency on short-term results enhances accountability and helps build trust.

Progress must be measured in real time so that countries can be held accountable for delivering on their commitments. For this to happen, we need clear and consistent data, broken down in ways that make sense to specialists and non-specialists alike. The key feature of EARTH INDEX is that it recalibrates annually, based on actual emissions progress. Since this will happen on a sector-by-sector basis, it will be crystal clear where the gaps are, both within and between countries.

Current progress in reducing emissions falls short of even the Paris targets; taking the G20 countries together, emissions actually went up in 2019. Bending the GHG emissions curve is an urgent imperative that will take monumental effort from all of us.

While existing climate initiatives assess countries’ policies and pledges in the context of global GHG emissions targets required to meet defined climate goals, EARTH INDEX measures the pace of reported GHG emissions reductions required to meet targets as laid out by countries.

DECARBONIZATION CASE STUDIES

Corporate Knights has been reaching out to companies to ask how they have successfully bridged the gap between what they’ve promised to do in the fight against climate change and how they’ve actually put that plan in action (in other words, the “say-do gap”). Among them were the following companies.

The Case for Smart Energy Management

![]()

Based in Turkey, Arçelik is among Europe’s three largest white goods company by market share, with over 45,000 employees and 30 production facilities in nine countries. Its 12 brands include Arçelik, Beko, Grundig, Arctic, Blomberg, ElektraBregenz, Flavel, Defy, Dawlance, Voltas Beko, Leisure and Altus. In line with its sustainability-based business model and vision of “Respecting the World, Respected Worldwide”, Arçelik aims to rejuvenate its industry and become a trusted “lifestyle solutions provider” to digital households. For three years in a row, Arçelik’s sustainability credentials led the company to score highest in the Dow Jones Sustainability Index’ DHP Household Durables category and placed them among the first cohort of companies to receive the Terra Carta Seal in 2021.

The following Q&A has been edited and condensed for clarity.

CK: Tell us about your smart energy management initiative in Romania.

Arçelik subsidiary Arctic, Romania’s largest appliance producer, opened the Arctic Washing Machine factory in Ulmi, just north of Bucharest, in 2019. Designed in collaboration with digital global technology pioneers, the plant is a model of Fourth Industrial Revolution (4IR) technologies in manufacturing and sustainability. Romania’s first factory to earn LEED Platinum certification, this plant now produces more than two million washing machines a year.

From the start, the plant employed a smart energy management system that collects and analyzes real-time data from 15,000 data points. To optimize energy usage, we also created a “digital twin” of the plant’s operating systems. Since the project’s completion in 2019, Arctic has been able to directly monitor the plant’s energy utilities and significantly reduce emissions.

CK: What were the specific objectives of this initiative?

Our objective was to develop a Building Management System (BMS) with a holistic approach that can visualize and control all utilities and equipment in the factory, enabling self-optimization through defined algorithms and real-time data. The BMS maintains a healthy, productive environment and provides access anywhere anytime to all the building’s systems: air handling and heating /cooling; lighting; power systems; energy management; and fire and security systems.

We also developed an Energy Monitoring System (EMS) for detailed analysis and forecasting.

CK: What has been done to date, and what’s left to do?

Arctic WM was built on a greenfield site, designed from scratch to be leading-edge. It incorporates more than 400 on-site energy measuring devices (e.g., energy analyzers, natural gas meters, air flow meters, water meters). In addition, we have numerous sensors (such as daylight intensity and presence sensors, temperature, pressure and humidity sensors) that collect data from the working environment. All this data is collected and processed in the BMS. With our pre-defined algorithms, the system optimizes itself as a closed loop.

We are still improving the system by adding new sensors and defining new algorithms. This year, for example, we implemented daylight sensors in our warehouse to expand the scope of the smart lighting management system. After analyzing the trend graphs collected by the BMS, we also invested in a lower-capacity air compressor for weekends and overtime, enabling us to increase the system’s overall efficiency. Collecting and reviewing production data empowers us to continuously devise improvements and make more informed decisions.

![]()

CK: What new resources were required to develop this initiative?

We built a greenfield washing machine factory in line with our vision of ‘Respecting the World, Respected Worldwide’, using Arçelik’s next-generation manufacturing capabilities. We built a dedicated project team with multiple stakeholders, collaborating with technology pioneers such as Accenture, Siemens and SAP.

CK: Why did the company decide to undertake this initiative?

We see this factory as representing the future of Arçelik’s next-generation manufacturing in Europe. In conventional control systems, equipment is controlled independently. We decided to integrate the equipment to collectively control it all. Our vision was to create system-based dashboards to visualize real-time data, control the system with defined algorithms, and enable operators to run the systems in optimum conditions while reducing per-unit energy consumption.

CK: What other solutions were considered?

At first, we considered giving each monitoring system its own management system, or creating systems that would be controlled manually by human operators, as in most conventional systems. But these alternatives did not fit with our leadership approach to innovation, which is why we chose to integrate all the systems into one BMS with a lot of features.

CK: What emissions reductions has this initiative produced?

As this is a greenfield investment, we can’t directly compare “before and after” results. According to industry studies, however, the saving from using a Building Management System is generally around 16%. However, we are still in ramp-up phase and have not yet reached full capacity, so we believe we have achieved a 10% reduction in energy consumption so far. Given that assumption, we estimate our total energy saving at around 8,348 gigajoules (GJ) since the commissioning of the system – the equivalent of eliminating 684 tons of CO2 emissions.

And as the plant’s production rises, these savings will continue to increase.

CK: How much was invested in this initiative?

We invested 1.03 million euros (about $1.35 million CDN) in the hardware, software and commissioning of the EMS and BMS.

CK: How long will it take to realize a payback from these improvements?

Around 9 years.

CK: What other benefits beyond emissions reduction were achieved as a result of this energy- management project?

Maintaining a best-in-class working environment helps us increase employee engagement. With the BMS, we have been better able to monitor air quality in the working areas of the factory. Our HVAC (heating, ventilation and air conditioning) system includes CO2 sensors, so the BMS can automatically sense air-quality issues and maintain conditions at optimum levels.

Similarly, we closely monitor lighting levels in different parts of the plant to ensure they meet ergonomic requirements and Health and Safety standards.

In addition, our efforts have been recognized by several major organizations. As one of the world’s most advanced production centers, the Arctic WM factory has joined in the Global Lighthouse Network, the World Economic Forum initiative that aims to spread the best Industry 4.0 practices. Arctic WM has also been awarded the Platinum Certificate, which is the highest level in the LEED green building rating system, after evaluation by the U.S. Green Buildings Council (USGBC) – making Arctic WM the first LEED Platinum-certified plant in Romania.

The plant also serves as a “lighthouse” and a laboratory for Arçelik; we are actively transplanting the learning from this project to other Arçelik production sites. This has helped the company differentiate itself from its competitors and demonstrate our leadership through marketing and communications initiatives with varied stakeholders.

![]()

CK: What has made the investment “worth it”?

This was the first integrated project at Arçelik that was designed as a laboratory to test new technologies. We aggregate and process the real-time energy and process-related data from the field, create insights, and make our decisions with data – helping us decrease response times and make better decisions faster. And that’s all in addition to helping our company reduce its carbon footprint.

CK: What key learnings have you gained from this project?

We learnt the details of BMS and EMS systems. We developed in-house energy monitoring and performance evaluation tools, which we use in rolling out similar systems to other Arçelik production plants.

CK: What advice would you offer other companies looking to take similar actions?

Know what systems you want to monitor, and what data you’re trying to collect. The infrastructure, communication protocols and the equipment you use all depend on your specific needs. For new, greenfield plants, evaluating all these variables during the design phase will save time and reduce capital costs. Production constraints may make it difficult to introduce these initiatives in existing plants, but dividing the tasks into separate phases will help.

CK: What’s the next thing you plan to do to replicate the impact of this initiative?

We are implementing Building Management Systems and Energy Monitoring Systems into other Arçelik factories, new and existing, to collect the data to better manage our utilities and equipment.

By collecting data from more than 1500 energy measuring devices within 15-minute intervals, we have created our own in-house “Central Energy Monitoring” system. We can use this database to analyze real-time metrics at each plant. We are currently expanding this application to 60% of our production sites.

We have also created our own Energy Performance Evaluation Tool and expanded it to our global factories. With this system, each plant can forecast its electricity and natural gas consumption based on defined variables such as production quantities and Heating Degree Days. These new sites are using this tool for evaluation, and now preparing budgets based on this data.

For more information on this project, please see the related press release. Readers may also contact Fatih Memiş, Head of Energy Department, fatih.memis@arcelik.com.

Using clean heat to decarbonize the production of medicines

![]()

AstraZeneca is a global, science-led biopharmaceutical company that focuses on the discovery, development, and commercialization of prescription medicines in Oncology, Rare Diseases, and BioPharmaceuticals, including Cardiovascular, Renal & Metabolism, and Respiratory & Immunology. Based in Cambridge, UK, AstraZeneca operates in over 100 countries and its innovative medicines are used by millions of patients worldwide.

The following Q&A has been edited and condensed for clarity.

![]()

CK: Tell us about your U.K. “Clean Heat” initiative?

AstraZeneca (AZ): At AstraZeneca, sustainability is embedded in everything we do. As part of our flagship Ambition Zero Carbon program, we are partnering to build a renewable energy plant to provide clean heat and power across our company’s U.K. operations. Our commitment is for long-term purchase of the biomethane produced by the plant, which will be operated by U.K.-based Future Biogas Ltd.

CK: How does this project fit AstraZeneca’s climate strategies?

AZ: Our Ambition Zero Carbon program targets science-based absolute reductions in all our direct and indirect greenhouse gas (GHG) emissions sources across the value chain — Scopes 1, 2 and 3.

We aim to achieve net zero Scope 1 and 2 emissions by maximizing energy efficiency, shifting all our operations to 100% renewable heat and power energy sources, and electrifying our vehicle fleet. These activities will deliver a 98% absolute reduction by 2026, from a 2015 baseline. To compensate for any residual GHG footprint, we are investing in high-quality carbon capture and storage solutions in our energy supply chain.

We also aim to achieve science-based net zero value chain (Scopes 1-3) GHG emissions by engaging our suppliers to set and achieve science-based targets, and embedding low-carbon solutions in the design, production, delivery, use and disposal of our products. These activities will halve our value chain emissions by 2030, and deliver net zero by 2045. We will also go a step further and become carbon-negative by 2030 for all residual emissions.

CK: What’s the current state of AstraZeneca’s commitment to renewable energy?

AZ: We already purchase 100% renewable electricity through matching consumption with renewable energy attribute certificates at all our sites globally. But we still rely on natural gas, a fossil fuel, at many sites for heat and in some cases heat and power.

In the U.K., which accounts for 25% of all our global Scope 1 GHG emissions, 98% of our footprint is from burning natural gas in boilers and at one CHP (combined heat and power) plant. Through our U.K. Clean Heat program, at the end of 2021, we took our first steps towards transitioning to 100% renewable energy for both heat and power, by partnering with Future Biogas to build a new renewable energy plant that uses locally grown crops to generate biomethane as a substitute for natural gas.

This initiative, one of the first in the pharmaceutical sector, will supply the existing UK gas grid with more than 100 Gigawatt hours (GWh) of biomethane – enough to heat more than 9,000 homes. We aim to source a further 100 GWh from other sources of biomethane, such as wastewater treatment.

CK: Where is this project being implemented?

AZ: Biomethane will be injected into the UK gas grid to supply AstraZeneca sites in Macclesfield, Cambridge, Speke and Luton. The Macclesfield Campus is AstraZeneca’s largest gas user in the U.K.

In addition, our North American Clean Heat program is exploring options to support the decarbonization of fossil gas consumption across our North American operations. We are also investigating solutions for clean heat across our global site network.

CK: What are the objectives of the initiative?

AZ: With access to certified low- and zero-carbon fuels limited, we are striving to develop new sustainable sources to deliver on our emissions targets and support the global energy transition. Through our partnership with Future Biogas, we are decarbonizing the discovery, development and manufacture of medicines and vaccines.

Not only will this support our Scope 1 emission reductions, but the biogenic carbon dioxide (CO2) produced by the anaerobic digestion of the energy crops will be captured, compressed into liquid, and put into permanent storage in underground rock formations off the coast of Norway. This innovative process is known as BECCS — BioEnergy with Carbon Capture and Storage. It can generate negative emissions, compensating for the remaining 2% of our residual hard-to-abate scope 1 and 2 emissions.

CK: What is the timing of this project?

Construction of the Future Biogas plant will begin in 2023. The plant will supply a significant proportion of our UK biomethane needs by 2025.

CK: What resources, besides funding, were needed to ensure the success of the initiative?

AZ: Our Global CEO, Pascal Soriot, has taken active leadership in setting our sustainability agenda. Besides his direct involvement in our Ambition Zero Carbon initiative, he also champions the Sustainable Markets Initiative (SMI) Health Systems Taskforce, which focuses on developing sustainable health care. We are working with partners to drive action in three essential areas: digital healthcare, supply chains, and patient care pathways. The Taskforce’s aim is to decrease the environmental footprint of health systems while improving health outcomes. We firmly believe that strong leadership from the top is essential in driving sustainability transformation and ensuring the success of initiatives like our U.K. Clean Heat program.

![]()

CK: Do you see any other benefits to this initiative?

AZ: Our partner, Future Biogas, is adopting Science Based Targets and aims to achieve net zero operations by 2025 by using fully renewable power. This aligns with AstraZeneca’s goal that by the end of 2025, 95% of our key suppliers and partners will have science-based targets to limit global warming to less than 1.5C.

CK: Why did AstraZeneca decide to undertake this project?

AZ: The biggest barrier to decarbonizing our manufacturing sites is accessing sources of clean heat at sites with gas-fired boilers and CHP plants. Transitioning to clean heat will require U.K. industry to have timely access to fuels such as biomethane and green hydrogen, which are currently in short supply.

CK: What other competing initiatives were considered, and why were they not chosen?

AZ: The alternative way to deliver clean heat for Ambition Zero Carbon is to electrify our heat production, but the cost of electrification was much higher than investing in green gas capacity. In addition, the complexity and disruption in transitioning to electrical technologies such as ground source heat pumps and low temperature distribution make these options less attractive. Other technologies, such as hydrogen fuel or fuel cells, are not yet mature enough in the U.K. to meet our 2026 target.

CK: What knowledge or existing models have guided AstraZeneca on this journey?

AZ: Our Clean Heat strategy follows the Greenhouse Gas Mitigation Hierarchy.

- First: Eliminate emissions, through green design and new ways of working.

- Second: Reduce emissions by improving efficiencies and changing energy use behaviour.

- Third: Substitute traditional energy sources with renewables.

- Finally: Compensate for hard-to-abate emissions with high-quality carbon removal projects.

CK: What kind of impact will this initiative make on your organization’s GHG emissions?

AZ: Switching to “clean heat” energy sources at our U.K. manufacturing sites alone could reduce our Scope 1 and 2 GHG emissions by 59,000 tonnes of carbon dioxide equivalent each year – the equivalent of more than 11,700 passenger vehicles.

CK: How much is AstraZeneca investing in this initiative?

AZ: We are investing $1 billion to deliver on our global Ambition Zero Carbon program.

CK: What benefits or impacts beyond emissions reduction do you expect to achieve?

AZ: Investments at scale to deliver clean affordable heat alternatives like biomethane can help build a more circular economy, tackle the carbon footprint of existing waste streams, and help achieve net zero ambitions. But the Clean Heat program will also create new economic opportunities at our sites around the U.K.

The investment in a new biomethane plant will also boost the local economy. Utilizing crops grown locally using regenerative agriculture practices will build soil health, while the digestate produced from the anaerobic digestion process can be returned to the field, reducing the need for energy-intensive mineral fertilizers.

Overall, our commitment to adding new renewables to the energy systems in which we operate will help advance the global energy transition through the creation and growth of sustainable markets that our peers, suppliers and customers can all access for their own decarbonization.

CK: What learnings have you gained through this journey?

AZ: As an early adopter, we have uncovered a shortage of solutions around biomethane, such as getting the gas to site, taxation of green supply, and the lack of standards or trading platform around carbon capture certificates. We also have limited experience in setting up long-term gas purchasing contracts, and have been developing that expertise from scratch.

CK: How can your learning be applied to other projects in future?

AZ: We are now exploring options to source green gas in North America, Ireland and across our global network, wherever fossil gas is currently being used.

For more information on this project, see AstraZeneca’s Sustainability Report. Readers may also contact Ben Norbury, Associate Director – Global Climate Lead, benjamin.norbury@astrazeneca.com.

Solar energy just got better

BCE Inc. is the holding company of Bell Canada, which includes national telecommunications providers and extensive media and retail assets. Subsidiary Bell Mobility Inc. operates wireless services across Canada.

The following Q&A has been edited and condensed for clarity.

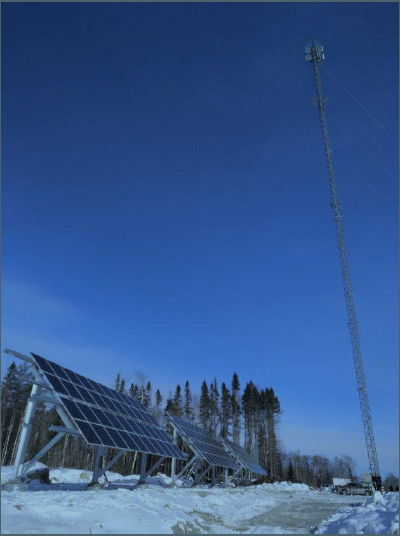

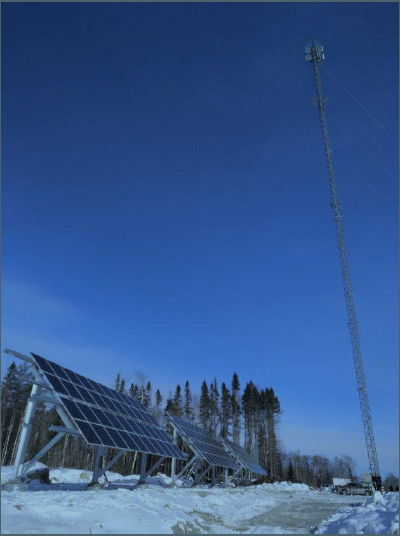

CK: Tell us about your initiative to prioritize renewable energy to power your telecommunications networks in remote communities.

BCE: Bell Mobility operates 14 off-grid sites in Canada. Our goal is to reduce our carbon emissions and prioritize renewable energy, especially in remote locations.

In 2021, we focused on the need for cellular coverage in and around Quebec’s environmentally-sensitive La Vérendrye Wildlife Reserve, 400 km northwest of Montreal. We partnered with the University of Sherbrooke’s Interdisciplinary Institute for Technological Innovation (3IT) and its Nanotechnologies and Nanosystems Laboratory (LN2), as well as with Saint-Augustin Canada Electric Inc. (STACE), to develop solar-powered systems that reduce the need for diesel generators.

CK: Where was the project actually implemented?

BCE: Bell teams are innovating with renewable energy at remote sites across the country, including in Ontario, Atlantic Canada, the Prairies and the Northwest Territories (NWT). The pilot project took place at Dorval Lodge in the centre of La Vérendrye Wildlife Reserve and its success has enabled us to incorporate and improve upon this technology at other sites, most recently along Manitoba’s Highway 6 near Grand Rapids.

CK: What were the goals of this initiative?

CK: What were the goals of this initiative?

BCE: Traditionally, we’ve powered our remote telecommunications towers with diesel generators. Using solar panels and batteries to power telecommunications is significantly decreasing our diesel consumption and greenhouse gas emissions. The project aims to reduce diesel consumption by a minimum of 40%.

All of our partners have been able to extract valuable lessons and benefits from this project. Bell is committed to maintaining our current renewable energy generation while exploring other opportunities to reduce the GHG emissions of our cell sites in remote areas.

CK: Why did the company decide to undertake this initiative?

BCE: One of our business goals is to expand our advanced 5G network across Canada to reach most of the population. Our 5G is currently accessible to more than 70% of Canadians, including more than 50 Indigenous communities. In 2021 and 2022, we’ve invested an additional $1.7 billion to our $4-billion annual capital expenditures to further expand and build our communications infrastructure. It was important to gain a better understanding of how we can manage energy use more efficiently and optimize the way we connect cellular towers together.

CK: How much have you managed to reduce GHG emissions?

BCE: While the project aimed to reduce diesel consumption at remote cell sites by 40%, it’s generated better results than expected. Working together, Bell and our partners found ways to reduce diesel consumption at remote sites by 75%. So far, this site has generated 16,000 kWh of renewable energy, saving 5,600 litres of diesel.

This is not our only renewable project. Our nine photovoltaic and diesel hybrid power systems in remote sites in the NWT, and our photovoltaic power system in Whitehorse, Yukon, generate approximately 130,000 kWh of renewable energy every year. They have saved approximately 27,000 litres of diesel, the equivalent of 73 tonnes of CO2 per year.

In Ontario, wind and solar power technologies installed at 12 remote cell sites have generated approximately 50,000 kWh of renewable energy a year, while in the Atlantic region our solar arrays at 10 sites generated about 70,000 kWh.

CK: How much was invested in this specific initiative?

CK: How much was invested in this specific initiative?

BCE: We invested nearly $400,000 in the Dorval Lodge project.

CK: How will you fund similar projects in future?

BCE: In April 2021, Bell took a defining step in aligning its ESG objectives and intentions for future financings by publishing the BCE Sustainable Financing Framework. The framework will guide future issuances of green, social and sustainability bonds or other sustainable financing options by Bell Canada. The proceeds will support a portfolio of eligible investments in 10 green and social categories, including energy efficiency, clean transportation, renewable energy and green buildings.

In May 2021, Bell Canada became Canada’s first telecom company to issue a sustainability bond. Our 2.20% MTN debenture offering, maturing in 2028, raised $497.6 million for allocation to eligible green and social investments.

CK: What benefits beyond GHG emissions reductions do you think Bell has achieved with the Dorval Lodge project?

BCE: Our network deployments in remote communities have many indirect impacts on local communities. Maintaining strong relationships with local communities and having the proper social license to operate in these remote communities that rely on our services is crucial to our brand reputation and maintaining customer loyalty.

CK: Why was this investment worthwhile?

BCE: This investment will unlock greater gains in creating a sustainable future, which is now a strategic imperative for our company. It offers a cleaner and sustainable way to continue deploying our network in remote regions. We have already seen the benefits: Using the technology developed for Dorval Lodge, our most recent Manitoba remote operation now performs even better than the pilot, consuming less than a tenth of the energy required at traditional sites. In other words, where Dorval Lodge consumes a fourth of typical grid-connected cell sites, our latest Manitoba site consumes only a tenth.

CK: What aspects of this project worked well, and according to plan?

CK: What aspects of this project worked well, and according to plan?

BCE: The actual performance of this system has followed our theoretical model quite well. It is important to understand the interaction between the solar modules and the batteries to improve future performance. The photovoltaic bifacial modules, which produce power from the back as well as the front performed well in the winter and seemed to clean snow more easily than the monofacial modules.

CK: What other learnings did you gain?

BCE: Weather conditions are still difficult to predict, and temperature fluctuations are important. It is not rare to go from -30C to +30C between seasons for this site. Temperature of the batteries was higher than expected during the summer, but was kept within acceptable range. We also learned that system components redundancy is important for reliable operation in remote locations.

CK: What advice would you offer to other companies working on similar renewable projects in remote locations?

BCE: Establish realistic project goals based on good simulations of the dynamic load of the site. And if harsh winter operation is expected, your battery cabinets should use the best thermal insulation you can afford.

CK: How do you plan to replicate or improve on this initiative in the future?

BCE: We are looking at the potential for additional renewable energy generation to further reduce our carbon footprint, perhaps from wind power or bio-diesel, depending on the resources on-site.

Bell is currently qualifying lithium battery vendors and technologies that are ideally suited for off-grid applications, efficient recharge and remote-monitoring capabilities. The batteries selected will be suitable for the grid-connected cellular network and off-the-grid sites.

For more information on this project, visit https://www.youtube.com/watch?v=uVL2erSk848. Readers may also contact Monika Potocki, Sr ESG Specialist, monika.potocki@bell.ca.

Orange is the New Green

Based in Kingsey Falls, Que., Boralex is a major player in renewable energy, specializing in wind, solar, hydroelectricity and electricity storage. It operates in Canada, the U.S. and France, with projects under development in the U.K. Boralex’s installed capacity now stands at 2.5GW, with more than 3.9 GW of wind and solar projects currently being developed.

Based in Kingsey Falls, Que., Boralex is a major player in renewable energy, specializing in wind, solar, hydroelectricity and electricity storage. It operates in Canada, the U.S. and France, with projects under development in the U.K. Boralex’s installed capacity now stands at 2.5GW, with more than 3.9 GW of wind and solar projects currently being developed.

The following Q&A has been edited and condensed for clarity.

CK: Boralex doesn’t just produce green energy – it champions sustainability and social responsibility. Tell us how the company is changing its business model to advance the green economy.

CK: Boralex doesn’t just produce green energy – it champions sustainability and social responsibility. Tell us how the company is changing its business model to advance the green economy.

Boralex: Traditionally, Boralex has served only large utility clients through long-term multi-year contracts. In 2020, however, Boralex entered a new client niche by signing its first Corporate Power Purchase Agreement (CPPA) with Orange, the largest telecom provider in France.

(Note: A Corporate Power Purchase Agreement is an energy purchase contract concluded directly between a company and a producer of green energy: The company commits to purchase a specific volume of energy at a predefined price over a period of three to 25 years.)

This agreement supports Orange’s energy-management activities and the sustainability of its networks even as data transmission volumes continue to grow. Orange has committed to three projects to reduce its carbon footprint: enhancing energy efficiency; targeting 50% renewable energy use by 2025; and reusing equipment to promote the circular economy. By providing green electricity to Orange, and then to other customers, Boralex is actively promoting and assisting the clean energy transition.

CK: What has been the timeline of your partnership with Orange?

CK: What has been the timeline of your partnership with Orange?

Boralex: Discussions with Orange began in late 2018, the contract was signed in July 2020, and it took effect on January 1, 2021. We have since signed additional CPPAs which contribute to other corporates’ targets, such as Auchan (24 GWh/year over three years), IBM (66 GWh/year over five years), Metro France (23 GWh/year over 20 years, based on a solar power plant to be commissioned this year, financed by the PPA), and l’Oréal (15 GWh/year over three years).

CK: What are the details of the agreement with Orange?

Boralex: This CPPA with Orange allowed Boralex’s Ally-Mercoeur wind farm, in the Auvergne Rhône-Alpes region of southern France, to secure the sale of its electricity at the end of its existing feed-in tariff contract (a regulated contract signed with the Government of France), which had been set to expire in December 2020. The contract was Orange’s first large-scale renewable power purchase agreement in France, which previously lacked a market structure around CPPAs. The contract parameters, parties’ responsibilities and financial model had to be built from scratch – a process that took more than a year.

Through this CPPA, Boralex supplies Orange with 67 GWh/year of renewable electricity generated by 26 wind turbines at the Ally-Mercoeur wind farm. The five-year agreement covers all of the electricity produced by the wind farm, which has an installed capacity of 39 MW.

CK: What were the goals of this initiative?

CK: What were the goals of this initiative?

Boralex: Our strategy shift, to serve corporate clients, was triggered by the need to provide corporations with clean and renewable energy that would support their own decarbonisation journeys. Since the 2015 Paris Agreement, corporates have increasingly committed to reducing and even eliminating GHG emissions from their operations (Scope 1) and their energy purchases (Scope 2). Boralex was well positioned to support these Scope 2 reductions, given the company’s 30-year expertise in building and operating renewable energy sites.

For Orange, its Engage 2025 strategic plan outlined the company’s commitment to achieve a net zero carbon footprint by 2040, despite increases in network data transmissions. This commitment demanded greater use of renewable energies, which by 2025 are expected to account for more than 50% of Orange’s electricity consumption.

By providing renewable energy at a fixed price over a five-year period, Boralex offered Orange stable energy costs and supplies. In light of recent hikes in energy prices across Europe, these factors have become even more relevant.

CK: What resources were needed to ensure the success of this initiative?

Boralex: Success hinged on three non-financial aspects of the arrangement: Boralex’s long expertise in renewable energy; building a positive, collaborative partnership with the team at Orange; and “tone from the top.” Both organisations were driven by their joint commitment to support Orange’s transition to a renewable energy mix.

For Boralex, working with corporate clients required adjusting our processes and internal structures, which were previously tailored to large scale, long-term contracts with state-regulated entities, to be more customer-focused. For example, we had to improve our decision-making agility, adapt shorter-term financial modeling, and work with third parties, such as transmission companies that could transmit the energy to the client.

CK: Why did the company decide to undertake this initiative?

CK: Why did the company decide to undertake this initiative?

Boralex: The CPPA market has been growing globally since the first significant agreement was signed by Google in 2010. Major buyers have typically been tech companies and data-centre owners such as Google, Amazon and Facebook. Initially, these were prominent public and para-public companies that were more motivated by the “green” value of a CPPA than by the price.

Boralex’s decision to explore CPPAs in 2018 was based on a few key drivers, the first being economics. With solar and wind now the lowest-cost energy sources, Boralex offers a competitive alternative in renewable energy – just as more and more companies face stakeholder pressures to reduce their emissions.

The desire to extend the life of Boralex’s assets was also a factor. The useful life of a wind farm is 20 to 30 years. As some of Boralex’s wind farms near the end of that cycle, CPPAs represent a responsible alternative to dismantling wind farms.

CK: What other competing initiatives were considered, and why were they not chosen?

Boralex: As the Ally-Mercoeur wind farm was nearing the end of its existing purchase obligation contract in December 2020, we saw a couple of alternatives for the future of the site.

- Dismantling the wind turbines and closing the site. This option was not optimal, because the turbines were still in highly operational condition.

- Repowering the site by replacing the existing turbines with higher-performance ones. But these procedures take time, and we wanted to first confirm the possibility and suitability of repowering at this site.

CK: What kind of emission reductions will come out of the Orange agreement?

CK: What kind of emission reductions will come out of the Orange agreement?

Boralex: We calculate that in 2021, production from the Ally-Mercoeur wind farm resulted in the avoidance of 3,632.5 tons of CO2.

CK: What benefits and/or impacts beyond emissions reduction were achieved?

Boralex: For Orange, the CPPA was a key step towards achieving the company’s emissions-reduction commitments – and demonstrated the company’s environmental leadership. Orange has also made substantial cost savings, given the recent spike in market prices.

For Boralex, this arrangement served as a stepping stone to gaining additional high-profile corporate clients, with further opportunities to grow our partnership in the future. In addition, the CPPA deal provided a practical example of how Boralex and the renewable energy sector overall can drive the energy transition in business.

As a next step, and thanks to the expertise developed in France, Boralex is now looking to establish CPPAs in other countries of the EU, and we’re currently discussing arrangements with potential clients in North America.

CK: What key learnings were gained from this initiative?

Boralex: As this CPPA was a first for both Boralex and Orange, it required that both companies build their respective expertise around the market and legal requirements, and collaborate closely to “figure things out”. While it took more than a year to establish the CPPA, that deal laid the foundations for the CPPA market in France.

The arrangement also proved a trigger for our company to review our own carbon footprint, and put in place strategies to reduce our own emissions, and better integrate the risks associated with climate change into our everyday decision-making.

CK: How can your learning be applied to other projects you plan to undertake?

CK: How can your learning be applied to other projects you plan to undertake?

Boralex: In retrospect, the success of this arrangement demonstrates the growing need to have renewable energy producers in the market as key players in the energy transition. According to France’s energy transition thinktank La Plateforme Verte, 40% to 60% of new renewable energy projects could be built under CPPAs.

CK: What advice would you offer to other companies looking to innovate in green energy markets?

Boralex: If your company is considering establishing a CPPA with a renewable energy provider, define your specific needs and priorities (volume, technology, contract duration, provider profile, price) early on, to identify relevant solutions and ensure the success of the process. There must be a strong alignment between top management and the teams involved in the project.

Look for reliable, professional energy producer-partners, because this will be a long-term relationship. Choose partners with financial solidity and expertise in several renewable technologies, to provide a more diverse (and stable) mix of energy sources. Also develop robust processes around environmental stewardship and engagement with local communities to consolidate “social license to operate” throughout the life of the asset.

Finally, innovate and think out of the box when establishing contract conditions. Don’t be afraid to test different models and co-build solutions with your energy partner that will best fit your needs.

For more information on this project, the original press release. Readers may also contact Jean-Christophe Dall’Ava, Director, Energy Markets, jean-christophe.dallava@boralex.com.

How Canadian Pacific is building hydrogen-powered locomotives

Among them was Canadian Pacific (CP), which launched an innovative program in 2020 to build North America’s first zero-emissions, hydrogen-powered, line-haul locomotive. The Hydrogen Locomotive Program has the potential to significantly reduce greenhouse gas emissions from locomotive operations, supporting CP’s climate change commitments and the transition to a low-carbon future in the freight rail sector.

The following Q&A has been edited and condensed for clarity.

CK: Tell us about your initiative to build hydrogen-powered locomotives.

Canadian Pacific: This initiative involves retrofitting three diesel locomotives with a combination of hydrogen fuel cells and batteries. Hydrogen locomotives will be supported by two small-scale hydrogen production and dispensing facilities to be constructed at CP yards in Alberta. Both hydrogen production facilities incorporate an electrolysis process to produce hydrogen from water. One facility will operate on renewable power from CP’s solar energy farm to produce zero greenhouse gas emission hydrogen fuel.

CK: What has been done to date and what is left to do in this initiative?

Canadian Pacific: CP is approaching this project across two phases. The first phase involved the conversion of a line-haul locomotive, in which the existing diesel engine and fuel tank are removed and replaced with a new power system architecture composed of fuel cell power modules, battery packs and hydrogen storage tanks. These components are integrated using a custom-designed control system. This initial prototype was substantially completed in December 2021, enabling CP’s project team to conduct the first successful movement test just 11 months after conversion began. We expect to have this locomotive in freight service trials in late 2022.

In June 2021, Emissions Reduction Alberta (ERA) awarded CP $15 million in funding to support two additional locomotive conversions and install two small scale hydrogen production and dispensing facilities to support locomotive testing and early operations. Expanding on the learnings from the first locomotive conversion, the project’s second phase involves retrofitting an additional high-horsepower line-haul locomotive and a smaller yard switcher locomotive. The three categories of locomotives converted during this program represent the vast majority of diesel-electric locomotives currently in freight service across North America.

CP’s Hydrogen Locomotive Program is demonstrating and evaluating the technical performance of hydrogen-powered locomotives and supporting fueling infrastructure in real-world operations. The program will generate critical industry knowledge and experience that will inform commercialization and future development.

CK: What resources (beyond financial) were needed to ensure the success of the initiative?

Canadian Pacific: Strong commitment and leadership from CP’s Board of Directors and President and CEO have been critical in undertaking this transformational project. To support this ambition, CP released our first Climate Strategy in July 2021, charting a path to reduce GHG emissions, adapt operations to the physical risks of climate change, and further position the company as a leader in the transportation sector’s transition to a low-carbon future. To guide this work, CP has established science-based emissions reduction targets. Innovative solutions, including the hydrogen locomotive program, are essential to reducing greenhouse gas emissions and advancing a low carbon future for rail operations.

To lead this project, CP has established a team of experienced and specialized engineers with locomotive engineer training. These specialized skills enable the team to accelerate the testing and validation process for the project. Creating a dedicated team has been essential in enabling the program to meet ambitious project milestones while maintaining robust rail operations. This team supports an innovation mindset at CP which is proving instrumental in pursuing the goals set out in our Climate Strategy.

As part of this project, CP is collaborating with other businesses and industry leaders to provide hydrogen and battery equipment, essential components, specialized installation services and operational and technical support. These relationships are critical in driving innovation and rapidly advancing emerging low carbon technologies for the freight rail sector.

CK: Why did the company decide to undertake this initiative?

Canadian Pacific: Transportation of freight by rail is the most fuel-efficient means to transport materials long distances over land. As CP continues to strategically grow our business, we must continue to curtail our own emissions, while simultaneously enabling reductions across the broader transportation sector.

Through our Climate Strategy, CP has committed to adapting our operations to limit GHG emissions, and established a Science Based Targets initiative verified target to reduce locomotive emissions intensity by 38% by 2030. CP has long invested in locomotive fuel efficiency to reduce the impact of our operations, achieving a 44% improvement since 1990. But to further reduce locomotive emissions, CP recognized the need to include alternative fuels and emerging technologies as part of our operations. As there are limited commercial-ready options to reduce emissions for line-haul freight locomotives, the company decided to launch an internal program to integrate low carbon hydrogen solutions into our locomotive operations.

Additionally, freight locomotives are long-term assets, with many of North America’s 30,000 locomotives expected to remain in service past 2050. Assuring that these locomotives can support low emissions freight rail operations in the future will require a practical means of achieving zero-emissions propulsion within the existing fleet. CP’s hydrogen locomotive program offers a potential solution to this challenge, allowing rail operators a retrofit technology that could have broad application across the sector.

CK: What proportion of your total GHG emissions does this represent?

Canadian Pacific: Locomotive operations are CP’s largest source of GHG emissions. In 2019 (the baseline year for CP’s science-based target), emissions from locomotives comprised 96% of our Scope 1 emissions, and 80% of our combined Scope 1, 2 and 3 emissions.

CK: What benefits and/or impacts beyond GHG emissions reduction were achieved?

Canadian Pacific: In addition to the potential for reducing GHG emissions, hydrogen fuel cells offer additional environmental benefits including the elimination of air emissions generated by diesel-electric engines. Hydrogen locomotives could also benefit local communities through reduced operational noise and vibration.

This project has been of particular interest to CP’s customers and other stakeholders that also have climate-related objectives as transportation emissions contribute to our customers Scope 3 emissions profile. Transportation companies are experiencing an increase in demand from customers interested in low carbon transportation solutions. Customers are increasingly looking to CP to collaborate on solutions to help support reductions within their own carbon footprint.

CK: What have you learned from this initiative?

Canadian Pacific: In pursuing our Climate Strategy, we aim to foster an enterprise-wide innovation mindset that encourages creative thinking and collaborative problem-solving to lower or potentially eliminate carbon emissions associated with the operation of CP’s assets, facilities and rolling stock. Through the process of identifying and evaluating new technology solutions, the Hydrogen Locomotive Project team exemplifies innovation in action.

This project has supported internal capacity building and helped identify new skillsets that benefit the business now and into the future. We are building the workforce and establishing resources to enable success for this and future projects across the organization. Programs like the Hydrogen Locomotive Project, in addition to CP’s ongoing sustainability performance, are helping to attract and retain top talent to help ensure our company continues to be recognized as a sustainable transportation provider well into the future.

CK: What advice would you offer to other companies looking to take similar actions?

Canadian Pacific: Climate action requires broad engagement and collaboration with customers, shareholders, governments, industry, communities, peers and other stakeholders to find and test new solutions.

Developing a climate strategy and science-based targets is an excellent way to enhance transparency and build trust and collaboration across value chains. Aligning emissions reduction targets with climate science increases credibility and provides stakeholders with a clear marker against which to measure long-term progress and sustainability. Ultimately, decarbonization efforts can provide an opportunity to build long-lasting, effective relationships with stakeholders to achieve mutual benefit and dedicated brand loyalty.

For more information on this project, visit Canadian Pacific’s website. Readers may also contact the CP Sustainability Team at sustainability@cpr.ca.

On Track to 2030

CN is Canada’s largest railway, with 32,831 km of track connecting the Atlantic, the Pacific and the Gulf of Mexico. The former Crown corporation employs more than 23,000 people and transports more than 300 million tons of goods and natural resources a year throughout North America.

CN is Canada’s largest railway, with 32,831 km of track connecting the Atlantic, the Pacific and the Gulf of Mexico. The former Crown corporation employs more than 23,000 people and transports more than 300 million tons of goods and natural resources a year throughout North America.

The following Q&A has been edited and condensed for clarity.

CK: What is CN doing to advance the electrification of freight transportation?

CN: In 2020, we signed a memorandum of understanding with Quebec vehicle manufacturer Lion Electric Co. to acquire 50 zero-emission trucks as part of our fleet, for use in our intermodal terminals in urban areas such as Vancouver, Toronto and Montreal. These custom-built electric trucks, which are now being designed, are part of a pilot program. They will be tested in a variety of situations and environments, from urban delivery and container shuttle service to port operations.

CK: What are your goals with this initiative?

CK: What are your goals with this initiative?

CN: By investing in innovative solutions for our trucking and intermodal services, we are working to advance the decarbonization of the entire transportation supply chain. We intend to use these net-zero trucks in different settings, to identify where they can make the most impact in terms of serving our customers and reducing our GHG emissions.

CK: What amount of emissions reduction do you hope to gain from this project?

CN: The 50 zero-emission trucks are expected to remove 100 tons of greenhouse gas emissions from the road annually.

CK: What proportion of CN’s GHG emissions would this represent?

CN: In 2020, trucking activities represented approximately 5% of CN’s scope 1 GHG emissions. While trucking emissions represent a relatively small portion of our emissions, we recognize that electrification of the freight sector will happen in waves, with medium and heavy duty trucks fleets electrifying earlier. By focusing on electric vehicles, CN and Lion are playing a leadership role in the transition to the economy of the future. This agreement is also part of our commitment to encourage economic recovery and reduce the carbon footprint of the global supply chain.

CK: What benefits beyond GHG emissions do you expect to achieve?

CK: What benefits beyond GHG emissions do you expect to achieve?

CN: This project is also spurring innovation and creating jobs in nearby communities. Thanks to agreements like this one, Lion Electric has seen its workforce grow from 200 employees at the end of 2019 to more than 1,100 today. CN has been headquartered in Montreal for more than 100 years, so we are very pleased to support innovation in Quebec.

CK: Tell us about CN’s “Renewable Fuels Partnership.”

CN: CN has set a target to reduce GHG emission intensity by 43% by 2030 based on 2019 levels. As one key lever to achieve this objective, in November 2021 CN announced a partnership to test high-level renewable fuel blends, including biodiesel and renewable diesel. Our partners are Progress Rail, a Caterpillar company that produces railway engines, rolling stock and infrastructure, and biofuel producer Renewable Energy Group. This is a first-of-its-kind long-term durability and performance test around bio-based fuels.

CK: When and where are these tests being implemented?

CN: The tests started in February 2022, and will continue over the next two years as different types of renewable fuel blends are introduced. The tests will take place on the Bessemer and Lake Erie portion of the CN network, operating in Pennsylvania and Ohio. This location was selected for its low winter temperatures, and the ability to keep locomotives in a relatively controlled test environment.

CK: What are the goals of this initiative?

CK: What are the goals of this initiative?

CN: Trials and qualifications of up to 100% bio-based diesel fuels are important steps in reducing GHG emissions from CN’s existing locomotive fleet while alternative-propulsion locomotive technologies are being developed. This program will allow CN and Progress Rail to better understand the long-term durability and operational impacts of renewable fuels on locomotives, especially in cold weather. It will help us identify needed modifications to fully leverage their usage over the next decade.

CK: These tests are still early-stage, but have you seen any successes so far?

CN: Since February, the testing of renewable fuel blends has had no impact on CN’s service to its customers.

CK: What resources were needed to develop this initiative?

CN: Our ability to obtain and use sufficient volumes of sustainable renewable fuels for testing requires collaboration between locomotive manufacturers and fuel producers. That’s why CN partnered with Progress Rail, one of the largest integrated providers of rolling stock and infrastructure solutions for global rail customers, and Renewable Energy Group, an international producer of sustainable fuels.

CK: Why did the company decide to undertake this project?

CN: CN is committed to adapting our business to changing climate conditions and to offering our customers lower-carbon transportation solutions. The successful testing and procurement of renewable fuels is part of a portfolio of initiatives to meet our 2030 science-based target.

CK: Finally, tell us about your work to develop electric locomotives.

CN: In support of our ambitious long-term sustainability goals, in November 2021 CN announced the purchase of Wabtec’s FLXdrive battery-electric freight locomotive, the first 100% battery-powered heavy-haul locomotive. The anticipated efficiencies and emission reductions from the technology, which can reduce fuel consumption and emissions by up to 30%, will help open the door to new alternatives beyond today’s diesel-powered locomotives. The technologies are still being developed, so we should see the locomotive running in 2024.

CK: Where is this project being implemented?

CN: The tests will be done in Pennsylvania, on the Bessemer and Lake Erie portion of the CN network.

CK: What are the goals of this initiative?

CK: What are the goals of this initiative?

CN: The new locomotive propulsion technology will help us meet the deep decarbonization required to achieve net-zero emissions by 2050.

CK: What resources were needed to ensure the success of the initiative?

CN: New locomotive propulsion technology requires collaboration with governments, supply chain partners, universities, fuel producers and locomotive/engine manufacturers. In this case, CN is partnering with Wabtec, a leading global provider of equipment, systems, digital solutions and value-added services for the freight and transit rail industries. The Department of Environmental Protection of Pennsylvania, recognizing the potential of this initiative, has provided $2.9 million in financial support under the Marine and Rail Freight Movers Grant Program.

CK: Why did the company decided to undertake this project?

CN: With approximately 85% of our GHG emissions generated from rail operations, we believe the best way to reduce our carbon footprint is by continuously improving our rail efficiency. This new technology is a key component in achieving an effective transition to a low-carbon future. We are also working with many of our customers to help them reduce their scope 3 transportation supply chain emissions and meet their decarbonization targets. We believe rail has a tremendous potential to reduce the environmental impact of transportation and we are committed to playing a key role in the transition to a more sustainable world.

CK: What benefits and/or impacts beyond GHG emissions reduction do you expect this program to achieve?

CN: This technology will decarbonize freight rail transportation, improve freight safety, and generate greater rail network utilization – all while reducing air emissions, including nitrogen oxides, fine particulate matter, and sulphur dioxide.

CK: How do you expect this initiative will grow over time?

CN: We have a large locomotive fleet in our North American network. The development of alternative technologies such as the battery-electric locomotive could eventually be expanded across all our operations.

We anticipate maximizing the use of this locomotive, starting with switching activities in a yard, and moving on to short-haul operations. The battery-electric locomotive is a defining moment for freight rail and will accelerate the industry toward low- to zero-emission locomotives.

For more information on these projects, see the related press releases: Electric Trucks; Renewable Fuels; Battery Electric Locomotives. Readers may also contact Francois Belanger, Director Carbon Transition, Francois.Belanger@cn.ca.

Powering Community Solar

Desjardins Group is North America’s largest financial cooperative, serving more than seven million members and clients. Founded in 1900, it offers a full range of products and services to individuals and businesses including banking, wealth management and insurance.

Desjardins Group is North America’s largest financial cooperative, serving more than seven million members and clients. Founded in 1900, it offers a full range of products and services to individuals and businesses including banking, wealth management and insurance.

The following Q&A has been edited and condensed for clarity.

CK: Tell us about your initiative in community solar power.

CK: Tell us about your initiative in community solar power.

Desjardins: As part of our commitment to reduce emissions, Desjardins has made a strategic investment in a U.S.-based, Canadian-owned company that specializes in enabling communities’ access to clean, affordable solar-powered electricity.

Until now, nearly half of consumers and businesses – mainly tenants of rental properties, but many others, for economic or technical reasons – have been shut out of the solar energy revolution because they are unable to install their own photovoltaic systems. Shared renewable-energy infrastructure solves this problem by providing homeowners, renters, and businesses equal access to the economic and environmental benefits of solar energy generation, regardless of income or location. Community solar provides renewable energy for all – particularly low-to-moderate income customers most affected by a lack of access – while building a stronger, more resilient electric grid.

CK: How does community solar work, in practice?

Desjardins: With community-distributed generation, or shared solar, the output of local solar-energy facilities is shared by local subscribers, often at a lower price than their current supplier charges. While the actual electricity generated goes into the local utility’s grid, participants receive credit on their electrical bills for their share of the power produced.

CK: How is this program being implemented, and where?

CK: How is this program being implemented, and where?

Desjardins: The company we’ve partnered with is Nautilus Solar Energy, based in Summit, N.J. It’s a pioneer of community solar, with solar operations and development projects in 11 states. Currently, 43% of the company’s energy generation takes place in New York State. Nautilus is owned by Montreal-based Power Sustainable, a global, multi-platform alternative asset manager that invests in sustainable infrastructure.

Desjardins is a financing partner of Nautilus and supports their development of community energy projects. Building community solar developments continues to be an important initiative for Desjardins as part of its own climate road map.

CK: What resources were needed to ensure the success of this relationship?

Desjardins: These types of initiatives require extensive collaboration with internal and external stakeholders. Internally from senior officers including risk management, operations, capital markets and legal teams. Externally from various third party experts including environmental, resources, legal, technical and insurance.

CK: Why did the company decide to undertake this initiative?

Desjardins: We have announced an ambitious action plan to achieve net zero emissions by 2040 in our extended operations, as well as in our lending activities and own investments, in three key carbon-intensive sectors: energy, transportation and real estate.

As part of its 2040 net zero ambition, Desjardins Group has committed to boosting the share of our lending to renewable energy projects from 24% of total energy lending in 2020 to 35% by 2025. This aggressive target serves two purposes: increasing our support to the renewable energy sector to accelerate the clean-energy transition, and reducing the carbon footprint of our loan portfolio.

CK: What made community solar such an attractive market to invest in?

CK: What made community solar such an attractive market to invest in?

Desjardins: This opportunity stood out to us from other renewable energy projects for its alignment with Desjardins Group’s purpose: to enrich the lives of people and communities. It also fit with many of our core values, including:

- Personal commitment: A cooperative is sustained by every member’s personal commitment to help meet shared needs. Community solar projects are meant to meet local energy needs in sustainable, inclusive and accessible ways;

- Democratic action: Participation is key to maintaining Desjardins’ cooperative nature, and community solar offers more people the opportunity to participate in the just energy transition;

- Solidarity with the community: At Desjardins, we are actively involved in communities’ socioeconomic development, in order to share wealth and support sustainable prosperity.

CK: What kind of GHG emissions reductions do you expect this partnership to produce?

Desjardins: GHG emissions reductions of each participating household or business will vary based on the local energy mix and the amount of energy consumed.

Beyond our community solar project, Desjardins conducted an exploratory analysis of the impact of the renewable energy projects we finance. We estimated that the electrical generation attributable to our renewables financing results in a decline of about 150,000 tons of carbon emissions, compared to fossil-fuel use.

CK: What benefits or impacts beyond emissions reductions do you think this project has achieved?

Desjardins: These low-carbon loans support our ambition to directly contribute to the energy transition of our communities. Benefits for the participating members and communities include affordable access to clean energy, and smaller personal carbon footprints for all subscribers and their families.

For more information on this project, visit Community Solar Explained – Coalition for Community Solar Access . Readers may also contact Olivier Lacaille, Managing Director, Desjardins Capital Markets, olivier.lacaille@desjardins.com.

Long-term Vision Reaps Rewards

![]() Iberdrola is a Spanish multinational electric utility company based in Bilbao, Spain. Its subsidiaries operate in numerous countries, including Spain, the United Kingdom (Scottish Power), the U.S., Mexico, Brazil, France, Germany, Portugal and Italy.

Iberdrola is a Spanish multinational electric utility company based in Bilbao, Spain. Its subsidiaries operate in numerous countries, including Spain, the United Kingdom (Scottish Power), the U.S., Mexico, Brazil, France, Germany, Portugal and Italy.

The following Q&A has been edited and condensed for clarity.

![]()

CK: Tell us about Iberdrola’s commitment to double, then triple, its renewable energy capacity.

Iberdrola: Iberdrola has been a pioneer in wind power since 2000, and the new plan reinforces our commitment to renewable energy in all our markets.

In 2020, Iberdrola announced an investment strategy that aims to double our renewable energy capacity by 2025 (compared to 2019), and to triple it by 2030, primarily through the use of solar photovoltaics and wind power. At the same time, we have closed all of our coal plants.

Iberdrola considers climate change an opportunity for growth through mitigation and adjustment activities throughout the transition to a low-carbon economy.

![]()

CK: What has been done to date, what is left to do?

Iberdrola: Iberdrola´s renewable energy capacity in 2019 was 32,042 MW. At the end of 2021, Iberdrola´s renewable capacity had risen by 19%, to 38,138 MW. Some 25,800 MW remain to be installed by 2025, and 57,000 MW by 2030.

In terms of coal generation, Iberdrola closed its last coal plant, in Spain, in 2020.

CK: Why did the company decide to undertake this initiative?

Iberdrola: In 2009 Iberdrola made a pioneering move by setting the fight against climate change as a strategic priority. Our current strategy and business model are aligned with the Paris Agreement and the 2030 climate agenda. Iberdrola is committed to continue assuming a leadership position directly and through partnerships, promoting awareness of the challenges and benefits of this transition, and contributing to a carbon-neutral and sustainable future.

![]()

CK: What impact will this program have on your company’s GHG emissions?

Iberdrola: The intensity of our emissions was 185 gCO2/kWh in 2015, and 96 gCO2/kWh in 2021. Our goal is to reduce CO₂ emissions to 50 gCO2/kWh by 2030, which represents a reduction of 73% compared to 2015. For more information, visit https://www.iberdrola.com/sustainability/environment/environmental-management/greenhouse-gas-inventory/intensity-emissions

CK: How much is being invested in this initiative?

Iberdrola: To achieve our business model, Iberdrola has positioned itself as a world leader in ESG financing. This has the threefold objective of:

- aligning our financial strategy with our purpose, values and investment strategy,

- optimizing the cost of our debt, and

- diversifying our sources of financing.

Our initial commitment was backed by investments of €120 billion between 2001 and 2020, to electrify the economy, update our systems and invest in innovation. The 2020-2025 period will see further investment of €75 billion to enhance renewables capacity, which will reach 60 GW in 2025 and 95 GW by the end of 2030, compared with 38 GW currently.

The company also expects to install 600 MW of operational green hydrogen by 2025, and to double the regulated value of its network assets – to €60 billion – by the end of the decade. This work will consume around 51% of our total capital expenditures through 2025.

CK: How long will it take to earn a return from these investments?

Iberdrola: Depending on the renewable technology used and the particularity of each project, return of investment is expected in 10 to 12 years, on average.

![]()

CK: What additional benefits beyond GHG emissions reduction have been achieved through these initiatives?

Iberdrola: Iberdrola’s leadership position and business performance through this period has increased stakeholders’ awareness of the company´s sustainability commitment, and boosted its competitive position, including its perception amongst analysts and investors.

CK: What makes these investments worthwhile?

Iberdrola: Companies’ economic, environmental and social activities are increasingly subject to scrutiny by specialized agencies. Analyses and ratings of this activity is published in specific reports. We are pleased that Iberdrola has emerged as a leader in the most important ESG indexes.

CK: How has this journey impacted the company itself?

Iberdrola: With over 170 years of history, Iberdrola is now a global energy leader, the world’s No. 1 producer of wind power, and one of the world’s biggest electricity utilities in terms of market capitalization. We have brought the energy transition forward two decades to combat climate change and build a clean, reliable, smart business.

Twenty years ago, the group was a pioneer in onshore wind generation. Over the last year, offshore wind power has now become a major business growth vector for the company.

![]()

CK: What learnings has the company gained through this process?

Iberdrola: Pioneering new technologies implies risk, but it’s essential to commit to innovation and research when technologies are still developing. Committing to clean and renewable energy offers a guaranteed long-term result, and Iberdrola saw the advantage of this factor early on.

CK: What advice or learning would you offer other companies looking to take similar actions?

Iberdrola: Iberdrola has set very ambitious long-term plans. But the vision of a leading company has to extend even further, and we are now working to set a path and develop sustainable goals beyond this decade.

For more on Iberdrola’s climate commitments, click here. For more information, readers may also contact Sustainability Manager Mónica Oviedo, at moviedo@iberdrola.es.

The road to zero

NFI is a Winnipeg-based bus and coach manufacturer that’s evolved into a global diversified provider of transit solutions, employing approximately 7,500 people across 45 facilities in nine countries. NFI is the parent company for a number of innovative subsidiaries, including North America’s largest transit bus manufacturer, New Flyer, which produced the world’s first hydrogen fuel cell-powered bus in 1994, and Alexander Dennis Ltd., the largest bus and coach manufacturer in the U.K.

NFI is a Winnipeg-based bus and coach manufacturer that’s evolved into a global diversified provider of transit solutions, employing approximately 7,500 people across 45 facilities in nine countries. NFI is the parent company for a number of innovative subsidiaries, including North America’s largest transit bus manufacturer, New Flyer, which produced the world’s first hydrogen fuel cell-powered bus in 1994, and Alexander Dennis Ltd., the largest bus and coach manufacturer in the U.K.

The following Q&A has been edited and condensed for clarity.

CK: Tell us how NFI is leading the march to zero-emission public mobility.

CK: Tell us how NFI is leading the march to zero-emission public mobility.

NFI: We’ve been producing zero-emission buses since 1969, but, in more recent years, the company has been ramping up its zero-emission offerings. From 2015 through the end of 2021, NFI delivered 2,032 equivalent units of zero-emission buses. (The company measures production in equivalent units; while a standard coach of 11 to 13 metres constitutes one unit, an 18-metre articulated bus counts as two equivalent units.)

In 2021, we introduced six new zero-emission bus and coach models. We like to say that NFI is leading the “ZEvolution”: the evolution to zero-emission public transport.

CK: Where are these vehicles being built, and where are they operating now?

NFI: We produce zero-emission buses (ZEBs) at all of our production facilities, in Canada, the U.S. and the U.K. Our ZEBs are currently in service, or on order, in 80 cities in six countries.

CK: What are the company’s objectives with this initiative?

CK: What are the company’s objectives with this initiative?

NFI: We currently produce buses and motor coaches of all propulsion types (clean diesel, hybrid-electric, compressed natural gas or “CNG”, trolley-electric, battery-electric and fuel cell-electric). As transit agencies transition their fleets to electric, NFI will produce more and more ZEBs. In 2020, ZEBs made up 9% of our annual deliveries. In 2022, NFI expects that percentage to rise to 20%-25%, and to 40% by 2025.

CK: What non-financial resources were needed to ensure the success of this initiative?

NFI: Our success depends on customer demand, a willingness to invest resources into zero-emission product and service innovation and development, partnerships with key suppliers, engineering resources, and innovation. Part of this requires long-term ZEB deployment planning and analysis – so time and preparedness is another resource needed to ensure success.

CK: Why did the company decide to undertake this initiative?

CK: Why did the company decide to undertake this initiative?

NFI: We saw growing customer demand, and increasing recognition that the future is electric. It’s better for our business, for the environment, and for the communities we live in. We could have innovated in any number of directions, but it has always been important to us to listen to our customers and to skate to where the puck is going.

CK: What kind of GHG emissions reductions have you seen from your ZEB products?

NFI: From 2015 to April 22, 2022 (Earth Day), NFI EVs (excluding our electric trolley buses) have travelled more than 100 million service kilometres. That equates to the prevention of 165,000 tonnes of GHG emissions.

CK: How much has NFI invested in this initiative?

NFI: NFI does not publicly disclose capital expenditures on specific projects. We have invested millions in both capital expenditure and research and development costs over the past 20 years, as we have expanded our battery, fuel cell, and trolley-electric technology (all of which are zero-emission).

CK: How long do you expect it will take to realize payback benefits from these ZEB investments?

NFI: We are already seeing the benefits. ZEBs provide a higher average selling price and are helping fuel our growth towards our 2025 targets. In addition, as we increase our volumes of ZEB sales, we expect to see economies of scale that will further provide economic benefit. The percentage margin on a conventional-propulsion (diesel, compressed natural gas) bus is still higher at the moment, but we expect that to move closer to parity over time.

Perhaps most important is customer payback. The total cost of ownership of a ZEB is steadily decreasing, which means that with each new innovation it costs our clients less and less to run their zero-emission fleets. For example, agencies can save up to $400,000 on fuel costs and up to $125,000 in maintenance costs over the 12-year lifespan of a battery-electric transit bus.

CK: What benefits or impacts beyond GHG emissions reductions has NFI received from this initiative?

NFI: Not only are our customers building more livable communities through cleaner air and reduced noise pollution (ZEBs are extremely quiet), we are seeing increased employee engagement (our employees are excited to work on these innovative projects), and access to broader pools of investor capital (e.g., ESG-focused funds). We’re also gaining an increased competitive edge. NFI has led many pilot projects to help transit agencies try out zero-emission vehicles, and many of those agencies are now coming back with larger and larger orders.

CK: Overall, do you feel that these investments have been worthwhile?

NFI: Absolutely. It’s not a matter of if the future of transportation will be electric, it’s a question of when. The average diesel bus emits more than 100 tonnes of carbon a year. NFI is proud of the investments we’ve made to drive market-leading technology that will help lower or eliminate emissions from buses and coaches.

CK: What parts of this project have worked out well for the company?