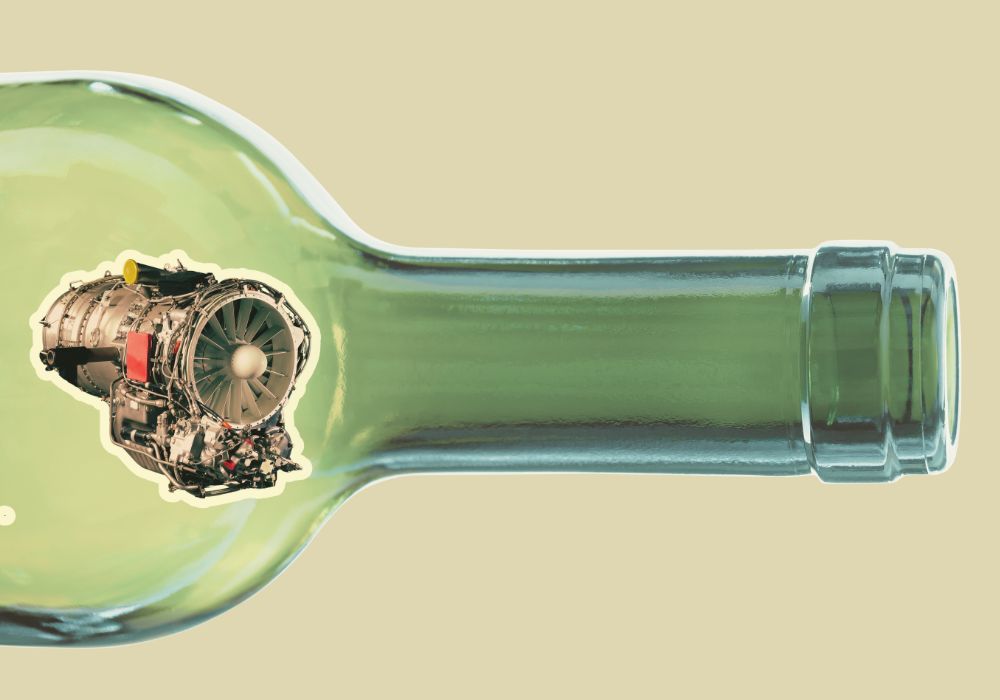

Canadian utilities are seeing longer delivery times, higher costs and tougher procurement logistics as they scramble to line up new gas turbines to help meet rising electricity demand, The Energy Mix has learned.

The supply bottlenecks trace back to manufacturers that already have orders backed up to 2029 or beyond but are in no hurry to invest in new production lines that may be in demand for only a few more years, according to news reports from the United States and Europe. Key factors in their business planning include the falling cost and increasing prominence of renewable generation, especially solar and wind, as well as mounting uncertainty over future demand growth from data centres.

In a late-February exposé, Heatmap News pointed to the widening gap between the rapid demand growth that utility planners are projecting and the deep challenges in getting turbine supply chains up and running. “Investors are betting on natural gas,” Heatmap wrote. “Where actually deploying new gas power is concerned, however, there’s a big problem: All major gas turbine manufacturers, slammed by massive order growth, now have backlogs for new turbine deliveries stretching out to 2029 or later.”

Usually markets speak pretty loudly, and the market is speaking very loudly that batteries are not only quick to deploy, but serve the need better.

– Doug Lewin, Host, Energy Capital Podcast

While the issue has received little or no attention to date in energy news coverage, “this looming mismatch between gas power demand and turbine supply is a real problem for the grid and everyone who depends on it,” Heatmap warned. “Forget visions of an all-of-the-above energy strategy. How about none of the above?”

The exposé cited GE Vernova, the biggest gas turbine manufacturer in the United States, to illustrate the bigger problem. “Rather than potentially overinvest in the face of rising demand and suffer the consequence of falling prices, GE Vernova and its competitors are committed to capital discipline, lengthening their order book, and defending shareholder value. Their reluctance to invest, while justified in some part by the nature and history of the industry, will threaten policymakers’ push for energy abundance – to say nothing about economic growth or innovation.”

Supply chain uncertainties threaten delays and higher costs

The disconnect between manufacturers’ fading enthusiasm for gas-fired generation and their customers’ expansion plans has already got Canadian utilities adjusting their procurement planning and budgets to keep power grids reliable. But a faster reduction in gas-fired generation would help reduce demand for a fossil fuel whose primary component, methane, is about 84 times more potent a greenhouse gas over the 20-year span when humanity will be scrambling to get climate change under control.

The supply chain issues are “worrisome, given the number of gas plants that provinces say they want to build,” Environmental Defence Canada programs director Keith Brooks told The Mix in an email, citing procurement plans in Ontario, Manitoba, Saskatchewan and Alberta. “It’s possible that these projects will be delayed, which is of course an issue for grid managers but also raises the potential for greater conflict with the federal Clean Electricity Regulations,” the Trudeau-era rule meant to set a phaseout deadline for gas-fired generation.

“I hope that gas plant proponents are following this closely, and taking this into account if they are thinking about putting in a bid for a new gas plant as part of any upcoming procurement,” Brooks added. “This backlog could affect service dates and costs, and could lead to penalties or contracts that are uneconomic.” That risk, in turn, “makes the case for more renewables, which can be built quickly, and for which the production capacity has been on a steady, exponential uptick due to burgeoning global demand that is anticipated to be sustained.”

Jay Wilson, director of energy security at Electricity Canada, said utilities have “lots of tools in the toolbox” to prevent delivery delays. But he confirmed in an interview that a utility ordering a new gas turbine today can expect a delivery date in 2029 for a large unit, somewhat earlier for a smaller one. “The overall trend is that just about any procurement is going to take longer than we would have expected it would, certainly pre-COVID, or maybe 10 years ago,” he said.

Post-pandemic, “uncertainty is really the byword, “ Wilson added. “About 10 years ago, we might have been able to call up an equipment supplier and have a proposal and get a commitment for a date in the future, and they could hold that manufacturing slot for you. Today, for most things that are mission-critical, our members would in lots of cases need to have a contract ready and signed and put a deposit down.”

While delivery of the turbines themselves is not in doubt, Wilson said, the supply chain problems and longer lead times drive up logistical complexity and financing costs. “The more uncertainty we are experiencing, the higher the overall cost is,” he told The Mix. “Just managing that risk means the amount of organization and effort that has to go into mitigating that risk increases.”

But Wilson acknowledged that “the production backlog still makes sense from the manufacturers’ point of view.”

Turbine makers see future with less demand for gas

For manufacturers, it’s a matter of weighing short-term demand against the future need for gas.

“It takes a lot of time and capital for manufacturers to spin up production since it’s a long-term investment for them, and as they’re considering doing so, they would be looking at the risks of demand declining,” wrote Scott MacDougall, electricity program director at the Calgary-based Pembina Institute. “I’m sure they’re looking at the competing market forces of rising gas turbine demand from data centres (and a lot of uncertainty about the actual size and rate of that rise), which could increase demand for gas turbines quite a lot, versus very strong and virtually certain global investment trends favouring solar, wind and batteries (currently two-thirds of global energy investment based on IEA data) over all other energy resources, including gas.”

RELATED

Hydrogen won’t rescue pension funds from bad bets on gas

Trump 2.0 could have some unintended upsides for the energy transition

What a nationwide grid network would mean for clean energy in Canada

Wilson said many utilities are still pursuing an “all of the above” strategy that calls for them to procure new gas plants at the same time that they invest in renewables. “Many of our members are considering gas turbines,” he said. But regulated utilities, in particular, must “very publicly provide the rationale for why this asset and not those assets,” based not only on their need for energy but also on grid services like capacity, managing peak demand and voltage. “It really comes down to what are the system needs, on what timeline, and what is available to fill that need,” he said.

But MacDougall said the shift away from gas “is likely to accelerate” as falling costs make renewable technologies “even more competitive with gas-fired power. With that kind of uncertainty, I’m not surprised they aren’t ready to commit to expanding production.” Brooks agreed that future gas demand “looks like it will be more ephemeral, and thus less attractive for manufacturers to really bring on added capacity.”

The International Energy Agency (IEA) has been predicting since September 2023 that demand for all three fossil fuels will peak this decade before going into terminal decline. And veteran utility analyst Mark Winfield, professor at York University’s Faculty of Environmental and Urban Change and co-chair of the faculty’s Sustainable Energy Initiative, said the concern extends beyond gas-fired power plants. “One would think it wouldn’t just be gas affected by uncertainty about demand projections, but nuclear even more so,” he told The Mix in an email. But “so far as I can tell, Ontario and other provinces are plowing ahead with their expansion plans, and don’t seem very concerned about the uncertainties and risks in this space, particularly when they don’t have to answer to regulators about the prudence or cost-effectiveness of their plans.”

Without “meaningful oversight either by regulators or investors,” Winfield added, “there is less need for their planning processes to be responsive to changing circumstances.”

The last gas turbine market crash still looms

The impact of the manufacturers’ reluctance will be compounded by a “toxic cocktail” of low investment in gas due to static demand and renewables supply chain shortages that have impeded new project development, all at a time of “unprecedented demand growth,” Heatmap said. The overall picture prompted NextEra CEO John Ketchum to advise investors that new gas projects “won’t be available at scale until 2030, and then only in certain pockets” of the United States. “The country is starting from a standing start,” Ketchum said. “This is an industry that really hasn’t seen any active development or construction in years,” and “all of that puts pressure on cost.”

GE Vernova is expressing a similar concern in Germany, where the incoming coalition government is planning to bring 20 gigawatts of new gas-fired generation online by 2030, Berlin-based daily newspaper Der Taggesspiegel reports. But GE Vernova’s executive director of business development, Markus Becker, said that “very ambitious” goal would depend on accelerated project approvals, clear “framework conditions” for its customers, and quick approval by the EU Commission.

Sightline Climate’s CTVC newsletter says the other two major turbine manufacturers, Siemens Energy and Mitsubishi Power, are in the same position as GE Vernova. Even though they’re “overwhelmed with orders,” CTVC writes, the Big Three “are wary of betting big and getting burned” after going through a previous gas turbine market crash that forced Siemens to lay off 7,000 and GE to restructure its business nearly a decade ago.

Gas peaker plants struggle to compete against batteries

In February, Rich Voorberg, president of Siemens Energy North America, told a conference audience that “gas turbines were dead in 2022,” Power Engineering reports. Now, “frankly, we can’t make enough gas turbines to support this market.”

But even so, “the lead times even for small turbines are increasing,” said Aad den Elzen, vice president of power generation and strategic growth at Solar Turbines, the world’s biggest manufacturer of industrial gas turbines. “Basically, we are all depending on the same supply chain,” den Elzen said. “The same suppliers are pushed for more by the power generation and the aerospace industries, but all of us are spending a lot of time and energy to understand the full supply chain until every last bottleneck is opened.”

Those bottlenecks have already spelled the end of two gas peaker plants, the 930-megawatt Perseus project and the 483-megawatt Spenser facility, that French multinational electric utility Engie wanted to build in Texas, Latitude Media reports. “The reality of the situation is that it takes a long time to build gas,” energy podcaster and newsletter publisher Doug Lewin told Latitude. “And the costs are spiralling upwards . . . not just like in line with even high inflation,” but driven in part by a shortage of transformers and delays connecting new projects to the grid.

“Prices and procurement times for essential components like power transformers and cables have almost doubled in four years,” the International Energy Agency (IEA) agreed in mid-March, even as “the world moves toward a new Age of Electricity, with global power consumption set to increase strongly in the years ahead.” The IEA said its survey of industry leaders “found that procurement now takes two to three years for cables and up to four years for large power transformers – twice as long as in 2021. Specialized components face even longer delays.”

And meanwhile, “no matter how much the policymakers may wish it weren’t so, gas peakers are struggling to compete against batteries,” Latitude writes. “They basically serve the same market, and batteries are better,” Lewin explained. “Usually markets speak pretty loudly, and the market is speaking very loudly that batteries are not only quick to deploy, but serve the need better.”

Brisbane, Australia-based Quinbrook Infrastructure Partners, with more than US$30 billion in renewable-energy projects around the world, is reaching a similar conclusion, identifying solar and batteries as the new “baseload” for utilities and the “engine room of the energy transition,” RenewEconomy writes.

The prospect of a “death spiral” for local gas networks is raising pressure to protect consumers from the cost and risk of stranded assets, RenewEconomy reports, just as New York State utilities weigh whether to spend billions of dollars to replace aging gas infrastructure when electrification is cheaper for homeowners, New York Focus writes.